Thunderegg Accounting

Accounting for the 21st Century

Making Tax Payments Online

We encourage you to make tax payments online - it is easy, you get instant confirmation of payment, and it saves a stamp and envelope! Links to each agency's payment site are below:

- Internal Revenue Service (all Federal taxes)

-

Oregon Department of Revenue (all Oregon taxes, and TriMet SE Tax)

- Other states:

-

For guides on how to enter your payment to make sure it is applied to the right tax and time period:

Sometimes, the information needed to prepare your return is not available before April 15th. The IRS and most states (including Oregon) allow for an automatic 6-month filing extension. An extension gives you more time to file the return, but any tax is still due on April 15th. You don't have to make a tax payment to extend your return, though it is a good idea if you think your payments to date won't cover your taxes due!

Federal Extension Payments

To make a Federal (IRS) extension payment, go to the IRS Direct Pay page and click the "Make a payment" button. You can also make a payment in your IRS online account.

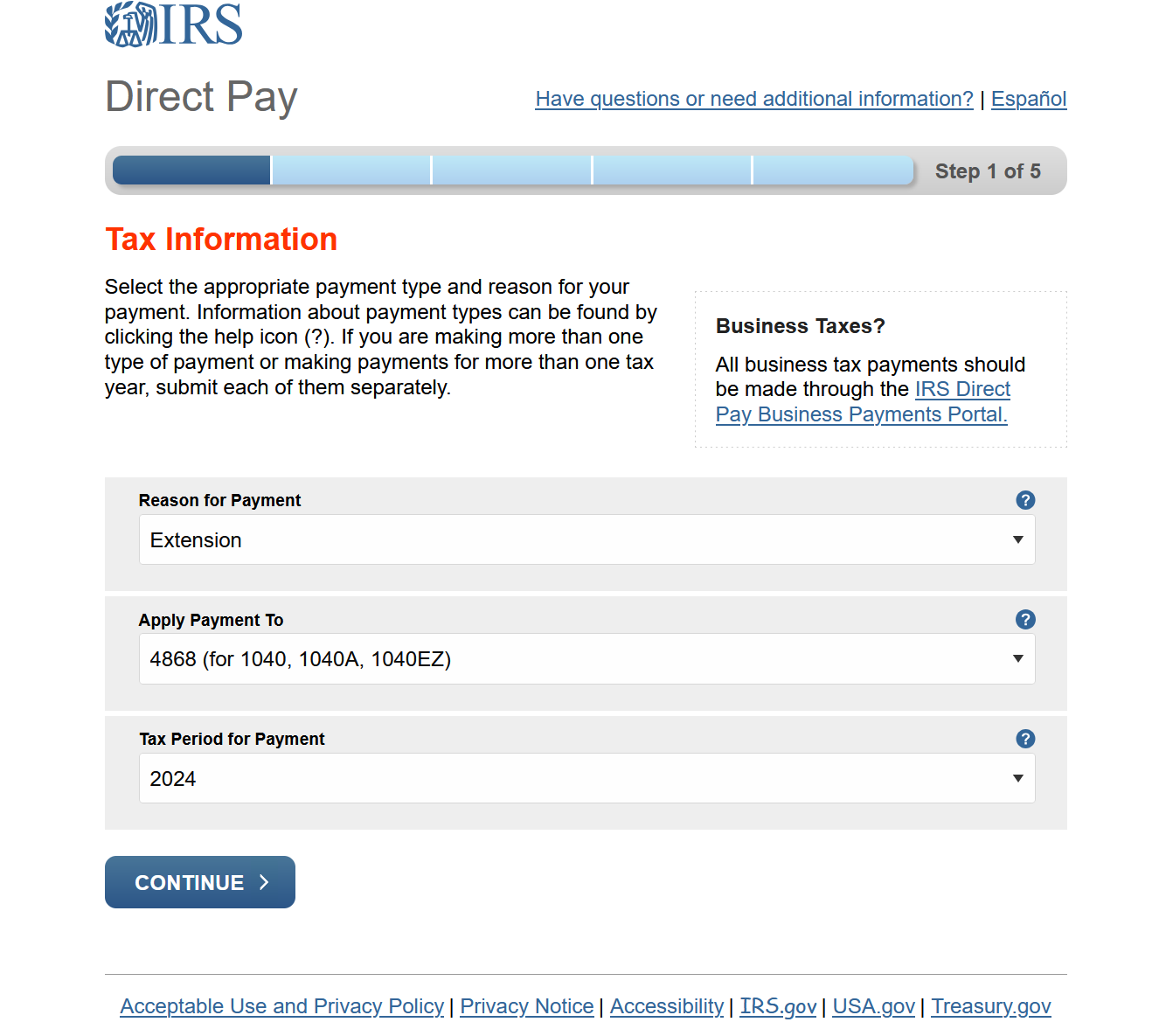

On the "Tax Information" screen:

-

Reason for Payment: Extension

- Apply Payment To: 4868 (for 1040, 1040A, 1040EZ)

- Tax Period for Payment: Select appropriate year (2024 for returns due April 15, 2025)

If using Direct Pay, you will need to verify your identity using information from a previous return. Complete the remaining screens with your payment details. Enter your email address to receive an emailed confirmation of the payment amount and date. Print a copy of the confirmation page for your records.

Oregon Extension Payments - OR-40

To make an Oregon extension payment for your individual tax return, go to Oregon Revenue Online and click the "Make a payment" button (under Quick Links). You can also make a payment through your Oregon DOR Online account.

Enter your name, SSN, and other information. When asked if you have a payment voucher with a media number, select "No."

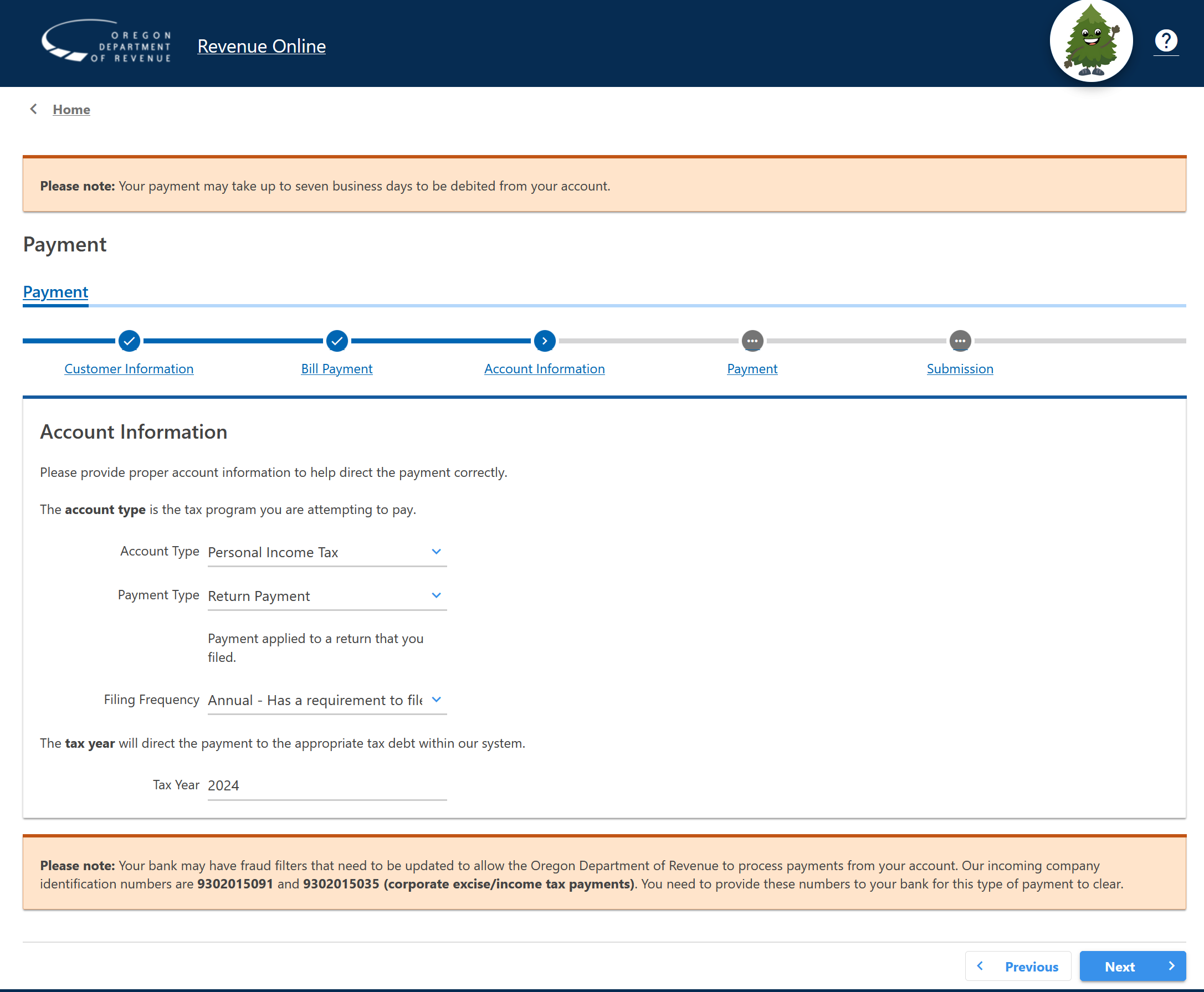

On the "Account Information" screen:

- Account Type: Personal Income Tax

- Payment Type: Return Payment

- Filing Frequency: Annual

-

Tax Year: Enter appropriate year (2024 for returns due April 15, 2025)

Complete the remaining screens with your bank account information and payment amount. A confirmation will be sent to your email. Print a copy of the confirmation page for your records.

TriMet Self-Employment Extension Payments - OR-TM

To make an extension payment for your TriMet self-employment tax return, go to Oregon Revenue Online and click the "Make a payment" button (under Quick Links). You can also make a payment through your Oregon DOR Online account. If this is your first time filing a TriMet self-employment return, you cannot pay online and must mail payment.

Enter your name, SSN, and other information. When asked if you have a payment voucher with a media number, select "No."

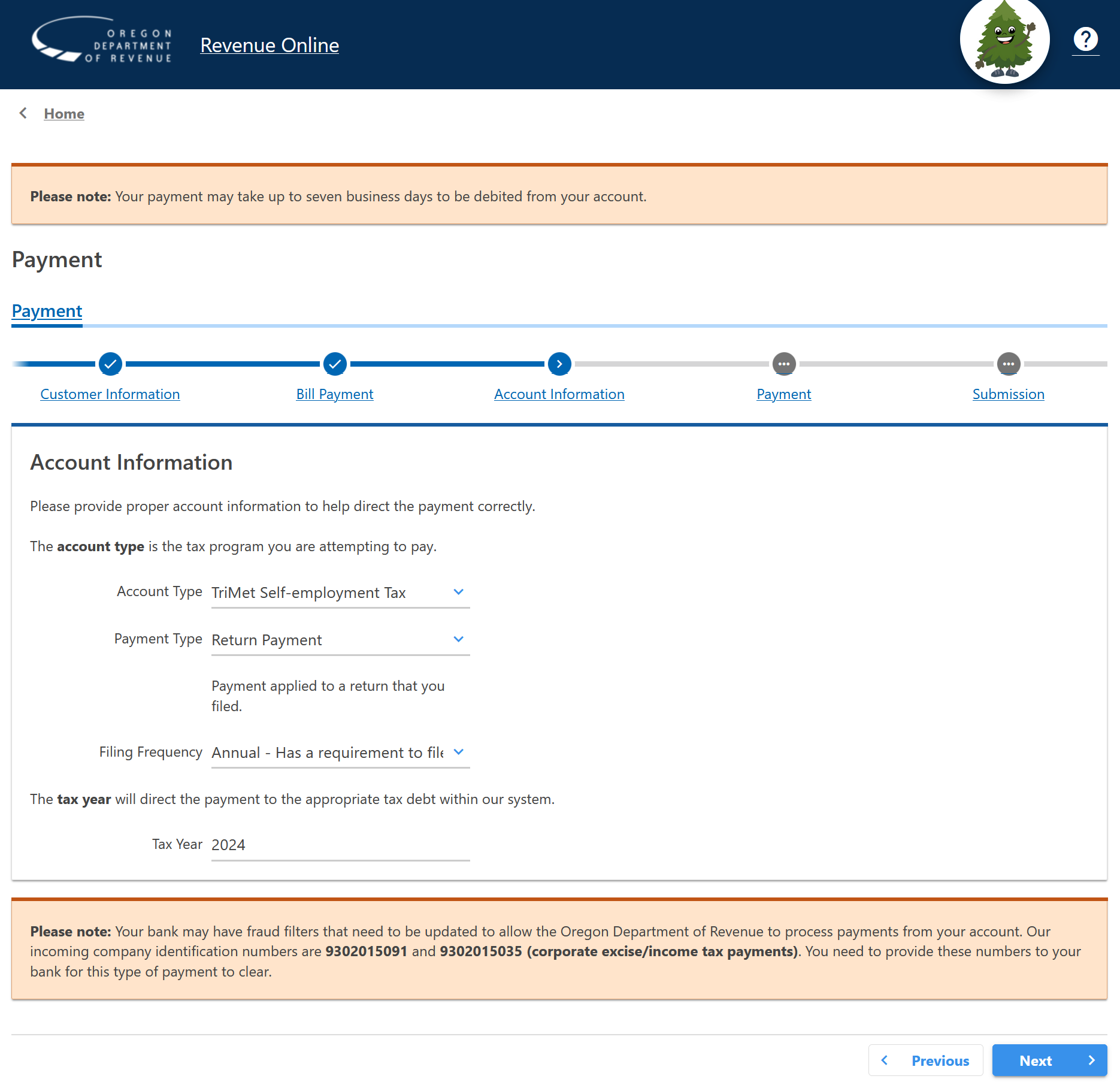

On the "Account Information" screen:

- Account Type: TriMet Self-employment Tax

- Payment Type: Return Payment

- Filing Frequency: Annual

-

Filing Period: Enter appropriate year-end (December 31, 2024 for returns due April 15, 2025)

Complete the remaining screens with your bank account information and payment amount. A confirmation will be sent to your email. Print a copy of the confirmation page for your records.

Multnomah PFA and Metro SHS Extension Payments

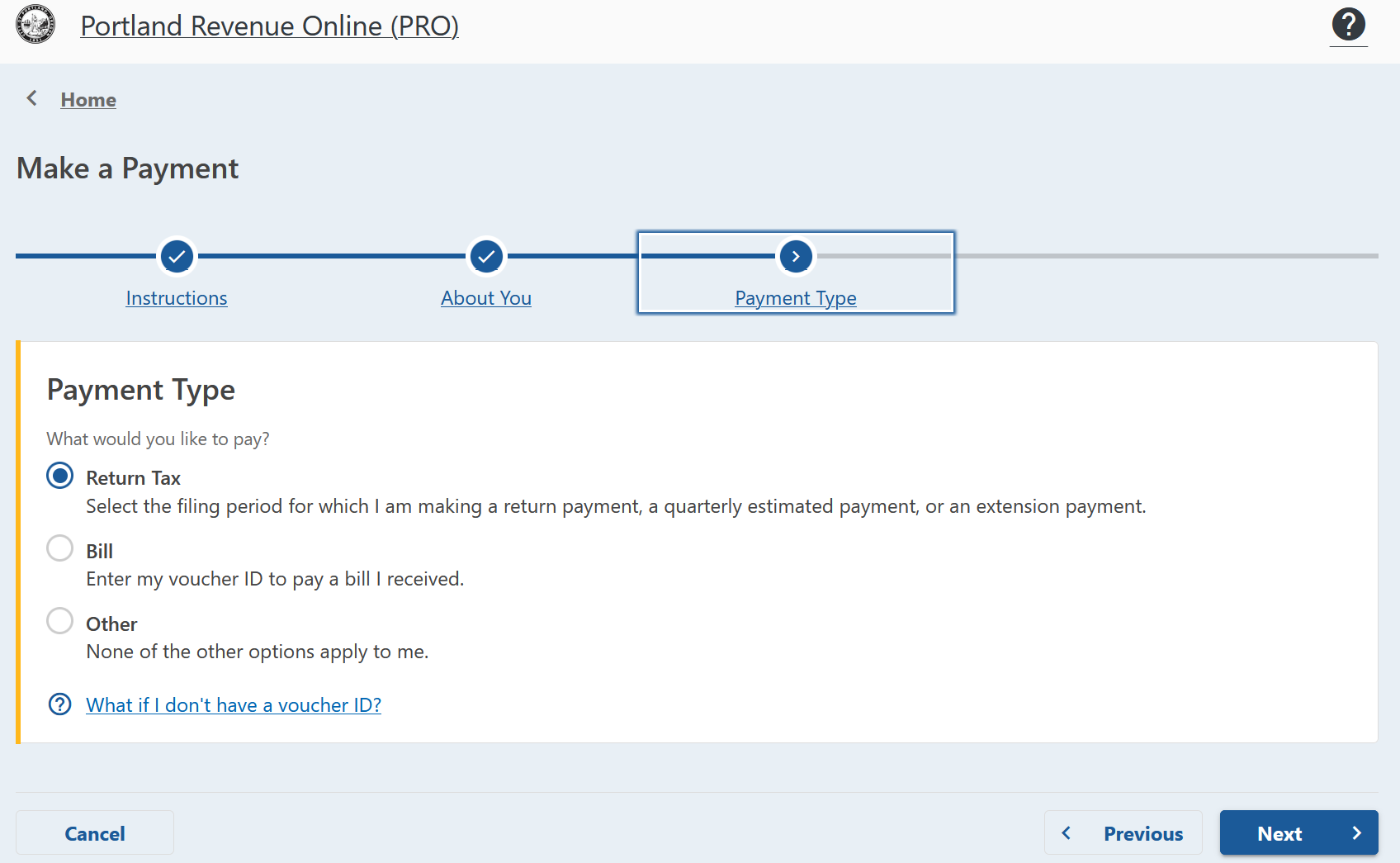

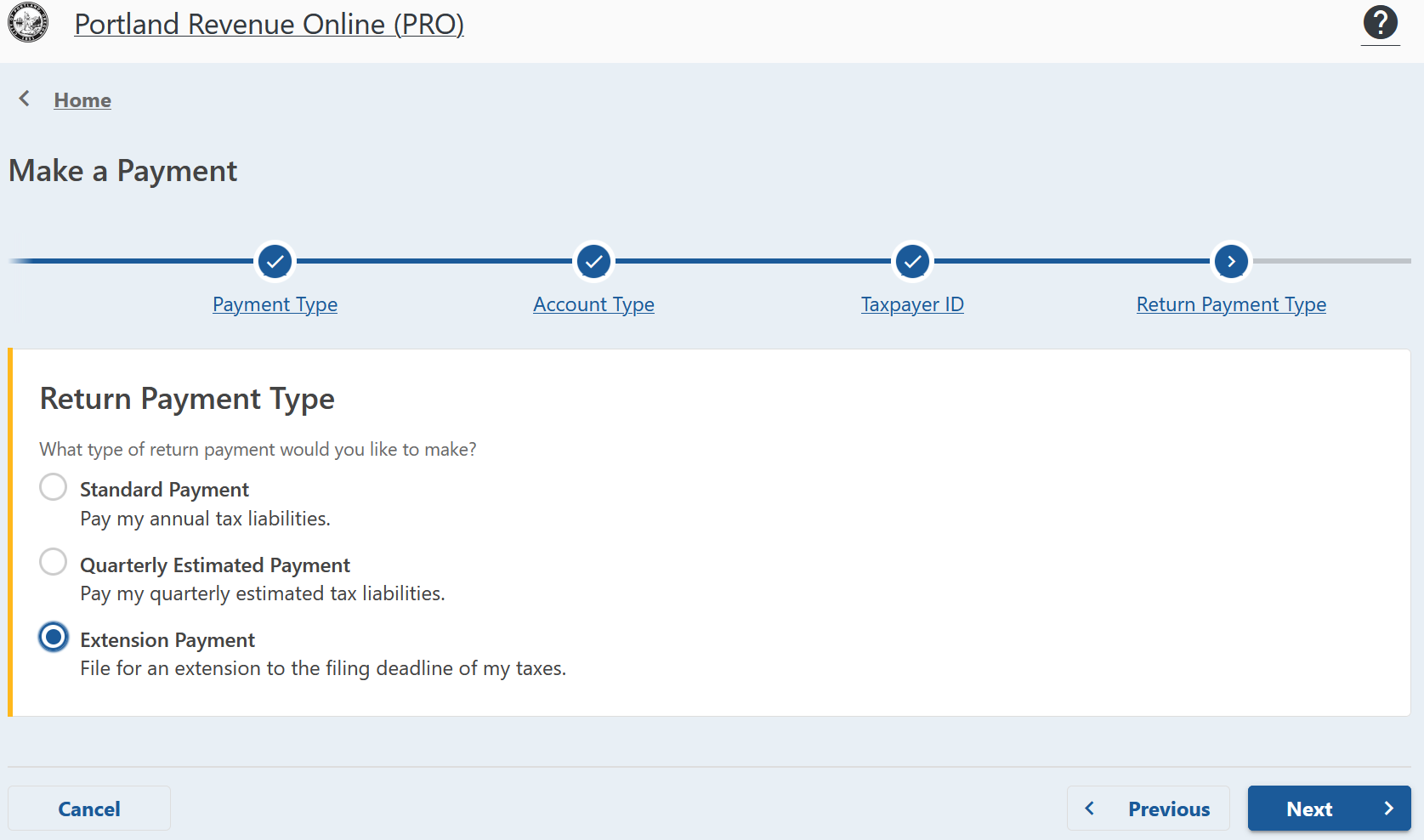

To make an extension payment for your Multnomah Preschool or Metro Supportive Housing tax, go to Portland Revenue Online and click the blue "Make a payment" link. Make these selections on the following screens:

- About You: Select "Individual"

- Payment Type: Select "Return Tax"

- Account Type: Select the tax you are paying. You must make separate payments for the Metro and Multnomah taxes.

- Return Payment Type: Select "Extension"

- Filing Period: Select the appropriate year (2024 for returns due April 15, 2025)

Complete the remaining screens with your bank account information and payment amount. A confirmation will be sent to your email. Print a copy of the confirmation page for your records.

Portland/Multnomah County Business Tax Extension Payments

To make an extension payment for your combined Portland/Multnomah County Business Tax, go to Portland Revenue Online and click the blue "Pay your business tax" link. Make these selections on the following screens:

- About You: Select "Business"

- Payment Type: Select "Return Tax"

- Account Type: Select "Portland/MultCo Business Tax"

- Taxpayer ID: If you are a sole proprietor (not an S-Corp, C-Corp, or partnership), enter your SSN. Otherwise, enter your EIN.

- Return Payment Type: Select "Extension"

- Filing Period: Select the appropriate year (2024 for returns due April 15, 2025)

Complete the remaining screens with your bank account information and payment amount. A confirmation will be sent to your email. Print a copy of the confirmation page for your records.

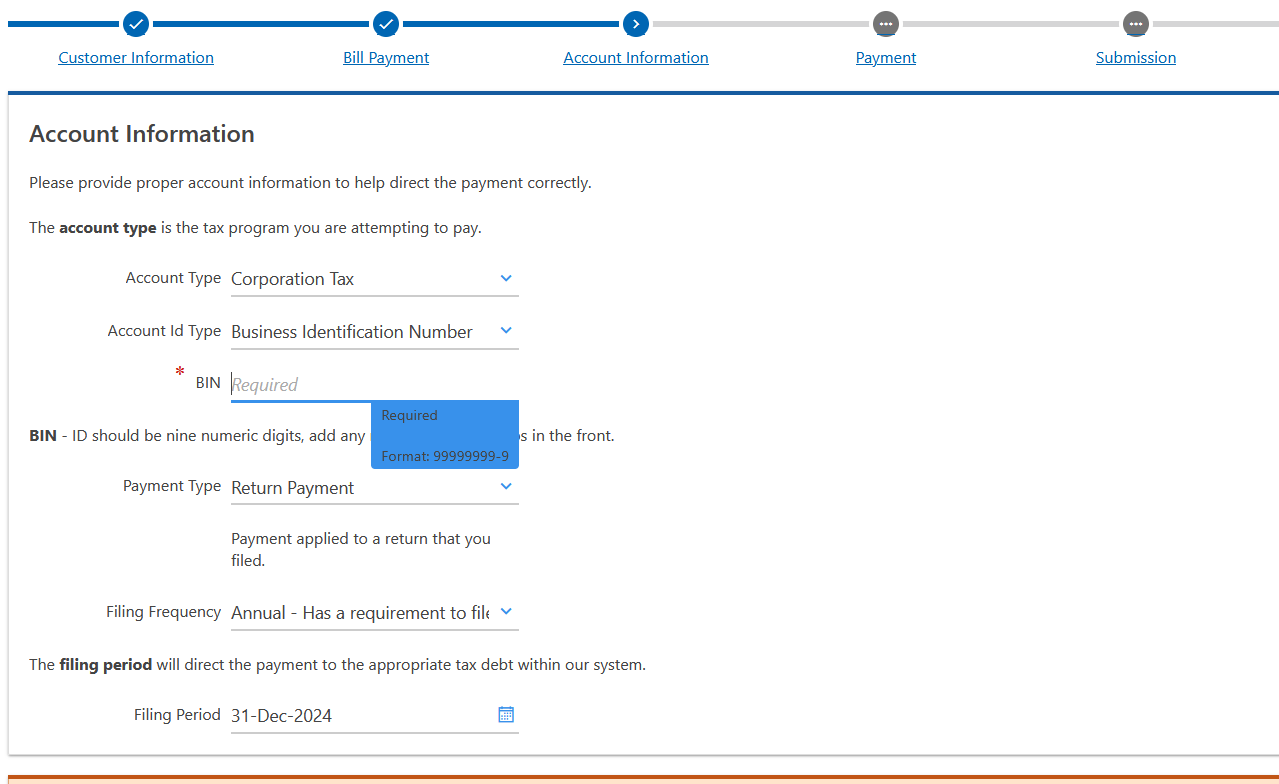

Oregon Corporate Tax Extension Payments

To make an Oregon extension payment for your corporate taxes, including the $150 minimum S-Corp excise tax, go to Oregon Revenue Online and click the "Make a payment" button (under Quick Links). You can also make a payment through your Oregon DOR Online account.

Enter your business's name and EIN. When asked if you have a payment voucher with a media number, select "No."

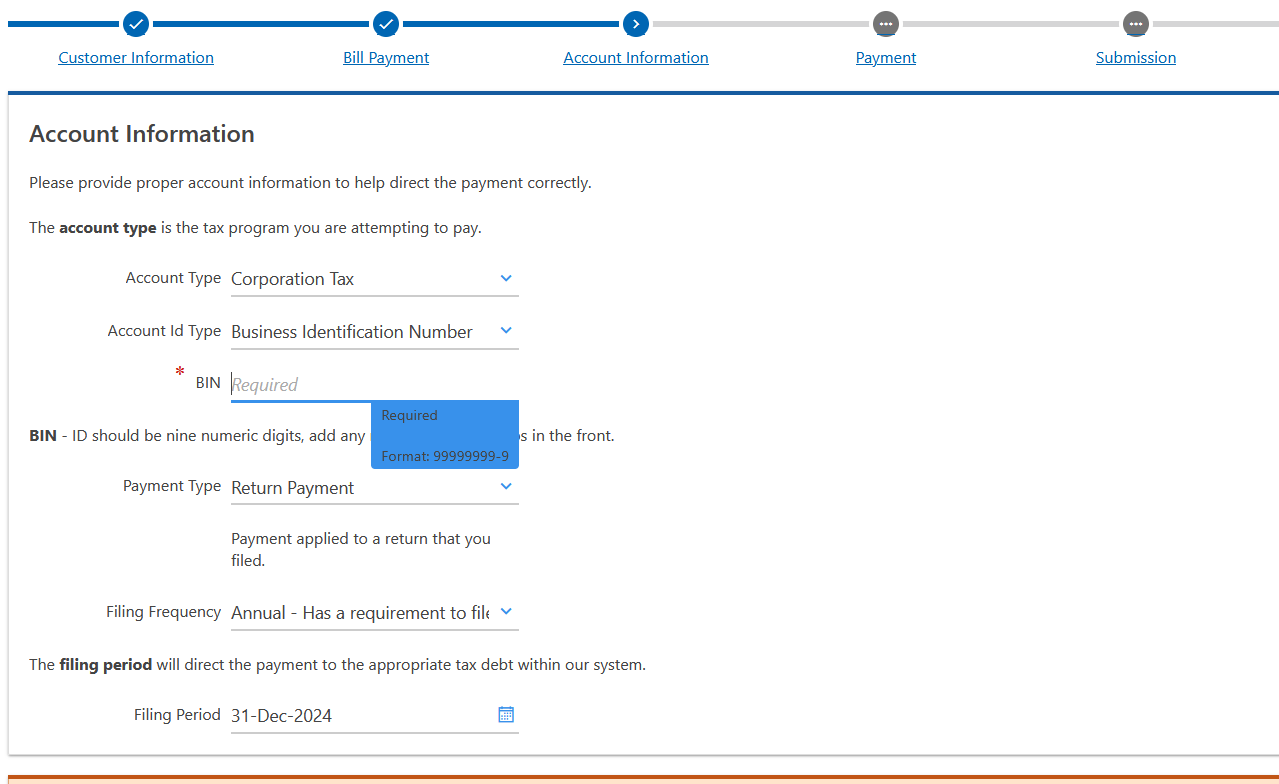

On the "Account Information" screen:

- Account Type: Corporation Tax

- Account ID: Enter your Oregon Business ID Number (BIN)

- Payment Type: Return Payment

- Filing Frequency: Annual

-

Filing Period: Enter appropriate year-end date (December 2024 for returns due in 2025)

Complete the remaining screens with your bank account information and payment amount. A confirmation will be sent to your email. Print a copy of the confirmation page for your records.

The IRS and state tax agencies require people to pay tax through the year as they earn income. These payments are made either through withholding from paychecks, or as estimated payments, or a combination of both. If you don't pay enough through the year, you may have to pay interest and penalties on the unpaid amount. Also, you may have an unwelcome tax bill in April. Estimated payments are generally due 4 times a year, on April 15, June 15, September 15, and January 15 (following year).

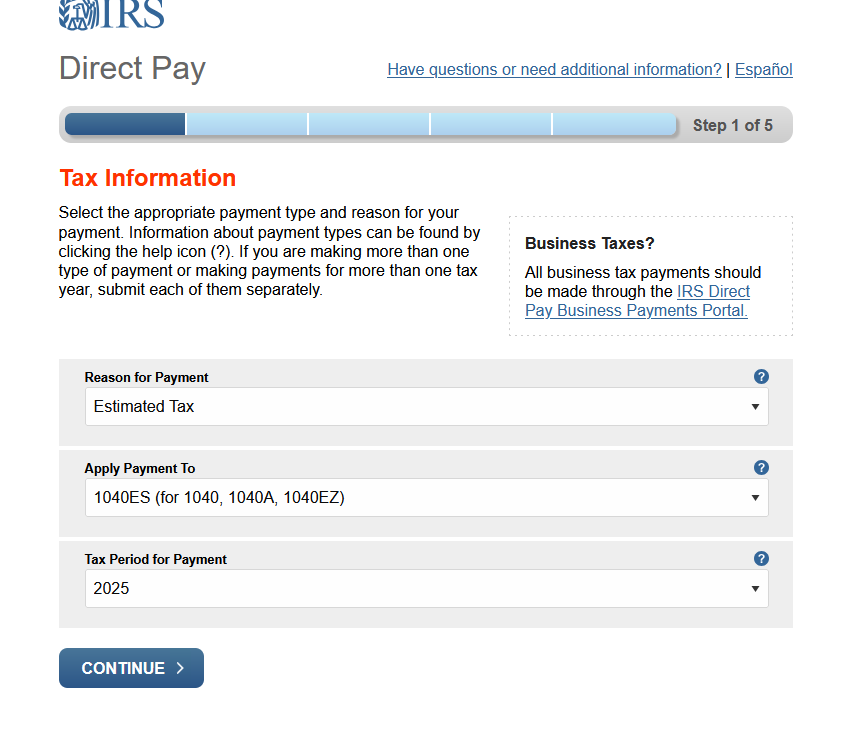

Federal Estimated Payments

To make a Federal (IRS) estimated payment, go to the IRS Direct Pay page and click the "Make a payment" button. You can also make a payment in your IRS online account.

On the "Tax Information" screen:

-

Reason for Payment: Estimated Tax

- Apply Payment To: 1040ES (for 1040, 1040A, 1040EZ)

- Tax Period for Payment: Select appropriate year (2025 for returns due April 15, 2026)

If using Direct Pay, you will need to verify your identity using information from a previous return. Complete the remaining screens with your payment details. Enter your email address to receive an emailed confirmation of the payment amount and date. Print a copy of the confirmation page for your records.

The IRS does not currently allow automatic recurring payments through Direct Pay, though you can schedule multiple payments, up to 365 days in advance.

Oregon Estimated Payments - OR-40

To make an Oregon estimated payment for your individual tax return, go to Oregon Revenue Online and click the "Make a payment" button (under Quick Links). You can also make a payment through your Oregon DOR Online account.

Enter your name, SSN, and other information. When asked if you have a payment voucher with a media number, select "No."

On the "Account Information" screen:

- Account Type: Personal Income Tax

- Payment Type: Estimated Payment

- Filing Frequency: Annual

-

Tax Year: Enter appropriate year (2025 for returns due April 15, 2026)

Complete the remaining screens with your bank account information and payment amount. A confirmation will be sent to your email. Print a copy of the confirmation page for your records.

Multnomah PFA and Metro SHS Estimated Payments

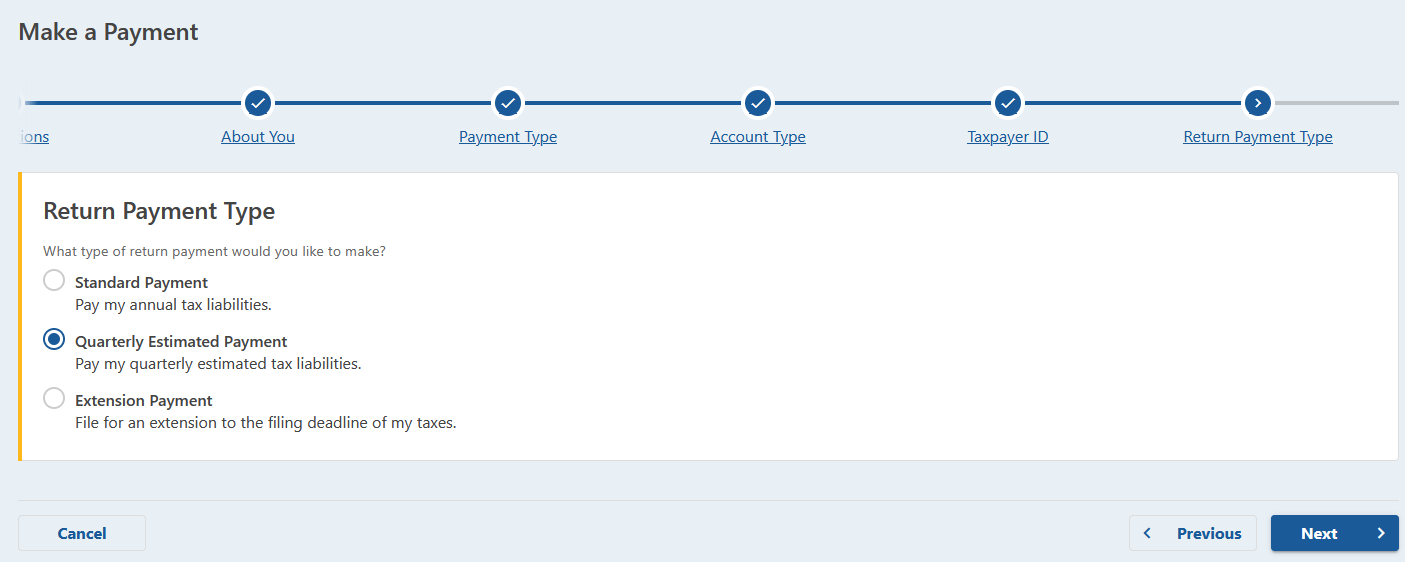

To make an extension payment for your Multnomah Preschool or Metro Supportive Housing tax, go to Portland Revenue Online and click the blue "Make a payment" link. Make these selections on the following screens:

- About You: Select "Individual"

- Payment Type: Select "Return Tax"

- Account Type: Select the tax you are paying. You must make separate payments for the Metro and Multnomah taxes.

- Return Payment Type: Select "Quarterly Estimated Payment"

- Filing Period: Select the appropriate year (2025 for returns due April 15, 2026)

Complete the remaining screens with your bank account information and payment amount. A confirmation will be sent to your email. Print a copy of the confirmation page for your records.

Portland/Multnomah County Business Tax Estimated Payments

To make an extension payment for your combined Portland/Multnomah County Business Tax, go to Portland Revenue Online and click the blue "Pay your business tax" link. Make these selections on the following screens:

- About You: Select "Business"

- Payment Type: Select "Return Tax"

- Account Type: Select "Portland/MultCo Business Tax"

- Taxpayer ID: If you are a sole proprietor (not an S-Corp, C-Corp, or partnership), enter your SSN. Otherwise, enter your EIN.

- Return Payment Type: Select "Quarterly Estimated Payment"

- Filing Period: Select the appropriate year (Dec-2025 for returns due in 2026)

Complete the remaining screens with your bank account information and payment amount. A confirmation will be sent to your email. Print a copy of the confirmation page for your records.

Your return is done but you owe tax! As an alternative to mailing a check, you can pay the amount due online.

Federal Return Payments

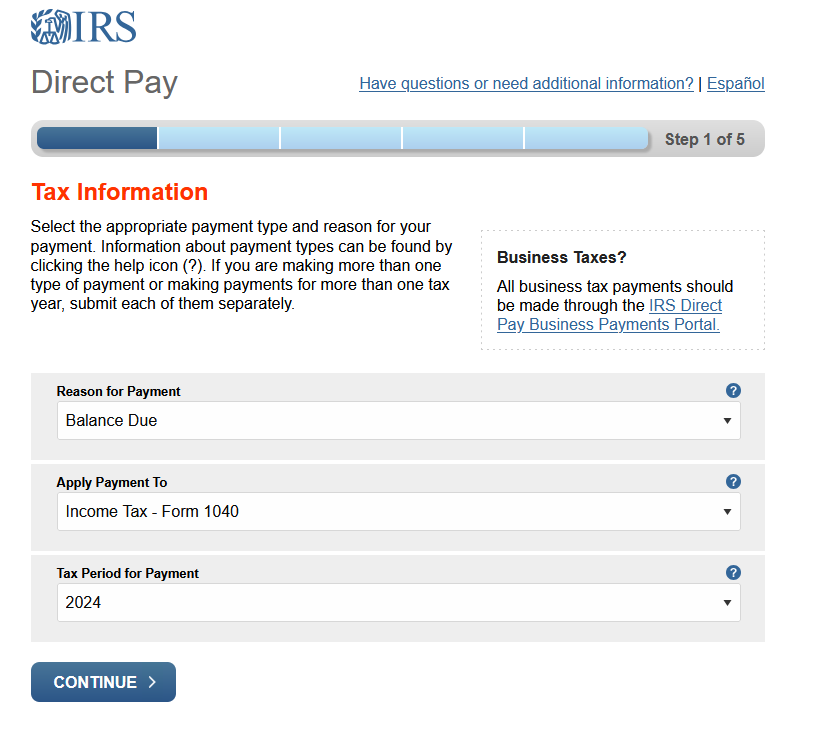

To make a Federal (IRS) payment, go to the IRS Direct Pay page and click the "Make a payment" button. You can also make a payment in your IRS online account.

On the "Tax Information" screen:

-

Reason for Payment: Balance Due

- Apply Payment To: Income Tax - Form 1040

- Tax Period for Payment: Select appropriate year (2024 for returns due in 2025)

If using Direct Pay, you will need to verify your identity using information from a previous return. Complete the remaining screens with your payment details. Enter your email address to receive an emailed confirmation of the payment amount and date. Print a copy of the confirmation page for your records.

Oregon Return Payments - OR-40

To make an Oregon payment for your individual tax return, go to Oregon Revenue Online and click the "Make a payment" button (under Quick Links). You can also make a payment through your Oregon DOR Online account.

Enter your name, SSN, and other information. When asked if you have a payment voucher with a media number, select "No."

On the "Account Information" screen:

- Account Type: Personal Income Tax

- Payment Type: Return Payment

- Filing Frequency: Annual

-

Tax Year: Enter appropriate year (2024 for returns due April 15, 2025)

Refer to the example above for making Oregon extension payments.

Complete the remaining screens with your bank account information and payment amount. A confirmation will be sent to your email. Print a copy of the confirmation page for your records.

TriMet Self-Employment Return Payments - OR-TM

To make a payment for your TriMet self-employment tax return, go to Oregon Revenue Online and click the "Make a payment" button (under Quick Links). You can also make a payment through your Oregon DOR Online account. If this is your first time filing a TriMet self-employment return, you cannot pay online and must mail payment.

Enter your name, SSN, and other information. When asked if you have a payment voucher with a media number, select "No."

On the "Account Information" screen:

- Account Type: TriMet Self-employment Tax

- Payment Type: Return Payment

- Filing Frequency: Annual

-

Filing Period: Enter appropriate year-end (December 31, 2024 for returns due April 15, 2025)

Refer to the example above for making TriMet extension payments.

Complete the remaining screens with your bank account information and payment amount. A confirmation will be sent to your email. Print a copy of the confirmation page for your records.

Multnomah PFA and Metro SHS Return Payments

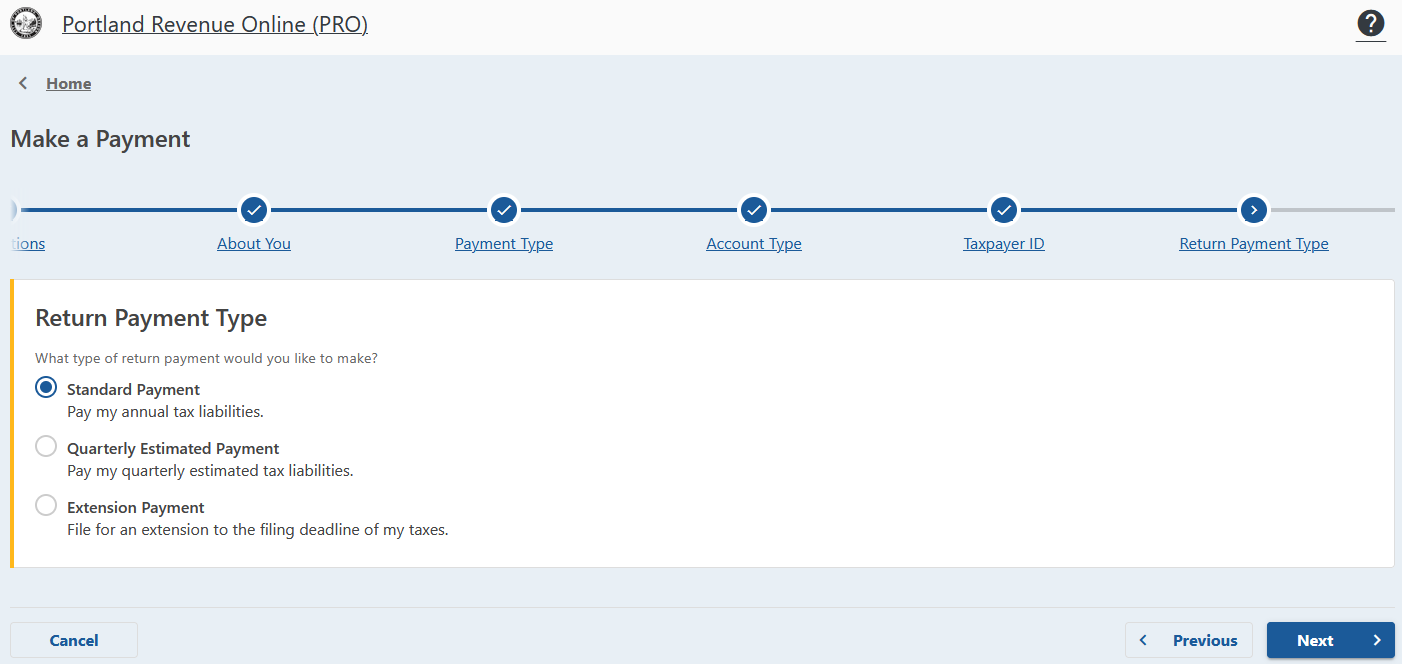

To make a payment for your Multnomah Preschool or Metro Supportive Housing tax, go to Portland Revenue Online and click the blue "Make a payment" link. Make these selections on the following screens:

- About You: Select "Individual"

- Payment Type: Select "Return Tax"

- Account Type: Select the tax you are paying. You must make separate payments for the Metro and Multnomah taxes.

- Return Payment Type: Select "Standard Payment"

- Filing Period: Select the appropriate year (2024 for returns due April 15, 2025)

Complete the remaining screens with your bank account information and payment amount. A confirmation will be sent to your email. Print a copy of the confirmation page for your records.

Portland/Multnomah County Business Tax Extension Payments

To make an extension payment for your combined Portland/Multnomah County Business Tax, go to Portland Revenue Online and click the blue "Pay your business tax" link. Make these selections on the following screens:

- About You: Select "Business"

- Payment Type: Select "Return Tax"

- Account Type: Select "Portland/MultCo Business Tax"

- Taxpayer ID: If you are a sole proprietor (not an S-Corp, C-Corp, or partnership), enter your SSN. Otherwise, enter your EIN.

- Return Payment Type: Select "Standard Payment"

- Filing Period: Select the appropriate year-end (December 2024 for returns due April 15, 2025)

Complete the remaining screens with your bank account information and payment amount. A confirmation will be sent to your email. Print a copy of the confirmation page for your records.

Oregon Corporate Tax Return Payments

To make an Oregon payment for your corporate taxes, including the $150 minimum S-Corp excise tax, go to Oregon Revenue Online and click the "Make a payment" button (under Quick Links). You can also make a payment through your Oregon DOR Online account.

Enter your business's name and EIN. When asked if you have a payment voucher with a media number, select "No."

On the "Account Information" screen:

- Account Type: Corporation Tax

- Account ID: Enter your Oregon Business ID Number (BIN)

- Payment Type: Return Payment

- Filing Frequency: Annual

-

Filing Period: Enter appropriate year-end date (December 2024 for returns due in 2025)

Complete the remaining screens with your bank account information and payment amount. A confirmation will be sent to your email. Print a copy of the confirmation page for your records.